Investors and traders around the globe keep a keen eye on the current gold rates, knowing that these figures are critical for informed investment decisions in gold. As market participants seek to navigate the landscape of precious metals, staying updated with gold market analysis garners actionable insights into the day’s trading potential. With gold’s status as a venerable asset class, understanding its daily price movements is essential for aligning investment strategies with market realities.

For those monitoring the pulse of precious metals, as of 8:20 am ET, the latest data show gold valued at $2,165 per ounce, marking a 0.34% rise from the previous day’s close. Keeping an eye on these fluctuations helps savvy investors to not only track short-term gains but to also strategize for long-term investment growth.

Understanding Today’s Price For Gold

Gold has long been a symbol of wealth and stability, its shimmering allure transcending cultures and time. In recent years, investors have closely monitored gold price drivers to make informed decisions. The daily gold price factors are influenced by a tapestry of global events and economic reports, which contribute to the gold market dynamics. Keeping abreast of these developments can provide strategic insights for financial portfolio management.

Factors Affecting The Daily Gold Rates

The confluence of varied influences makes the daily pricing of gold both complex and fascinating. Major economic indicators such as central bank decisions, inflation rates, and shifts in global economic conditions play cardinal roles. Supply and demand balance is another perennial key player, shifting with industrial demands and investor appetite.

- Global Economic Conditions: Economic health indicators are gauged to predict how investors might turn to gold as a safe haven.

- Inflation Rates: As inflation climbs, gold’s allure as a store of value generally intensifies, often pushing prices upward.

- Central Bank Policies: Policy changes by central banks including interest rate alterations can provoke swift reactions in the gold markets.

Market Dynamics And Today’s Gold Value

Market dynamics that determine gold’s value are fascinatingly multi-faceted. Constant monitoring of the relations between currency valuations, particularly the U.S. dollar, and gold prices forms a crucial part of investment decision-making processes. Moreover, geopolitical events can precipitate drastic fluctuations in the market, underscoring the importance of staying informed.

- U.S. Dollar Valuation: Since gold is predominantly priced in dollars, fluctuations in the currency’s strength can significantly influence gold rates.

- Geopolitical Turmoil: Global uncertainties often drive investors towards the relative safety of precious metals, bolstering gold values.

To truly understand the daily variance in gold prices, one must synthesize both the current market trends and historical data. It is the overlap of these realms that guides investors through the labyrinthine depth of the gold markets, illuminating the paths towards optimizing trading positions or choosing to hold.

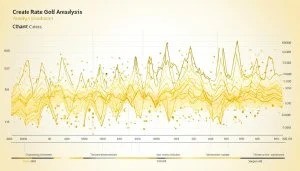

Daily Gold Price Trends And Analysis

In the landscape of commodities, gold price analysis plays a crucial role in financial markets and investment portfolios. With the price of the precious metal on an upward trend, increasing by 0.34% since yesterday, the value of staying abreast with the daily trends in the gold market cannot be understated. Investors seek gold trading insights to navigate through the market’s inherent volatility and to devise strategies that align with price movements.

The subtle fluctuations evident in gold’s valuation day-on-day point towards a broader economic narrative, where even fractional percentage changes can impact decision-making processes for traders and investors alike. To aid in such crucial analysis, let us explore key aspects:

- Volume Traded: Reflects the day’s market activity and helps in understanding the liquidity and interest levels.

- Price Variance: Indicates intraday highs and lows, offering insights into potential resistance and support levels.

- Market Sentiment: Assessed through trends and news impacting the perception of gold as a safe haven or a hedge against inflation.

For prudent investors and market participants, the incorporation of these facets into a comprehensive gold trading strategy is essential, enabling the forecasting of future movements and the optimization of portfolio returns.

Recent Movements In Gold Prices

Following recent trends in the gold market can offer a roadmap to understanding the nuances behind gold price fluctuations. As a measure of its performance, key timeframes such as the previous week and month serve as indicators for the metal’s market behaviors and investment allure. Let’s delve into these critical periods and unravel the intricate dance of gold price trends.

Week-On-Week Gold Price Fluctuations

The past week has seen an impressive surge in gold rates, heightening investor interest. Precise data points to a 2.34% elevation in gold prices, which reflects not just a short-term fluctuation but potentially sets a tone for the mid to long-term gold market movements. Analysts keep a close watch on these metrics, as weekly variances can ripple into larger waves, affecting broader market sentiments and strategies.

Month-On-Month Gold Appreciation Insights

Exploring the monthly landscape, we uncover that gold has appreciated by approximately 5.92% over the last thirty days. This persistent climb underscores a robust uptick in gold’s valuation, reinforcing the metal’s reputation for securing asset value and fostering investment growth. By charting these gold price trends, market watchers can gauge investor confidence and forecast impending market adjustments.

- Weekly gain of 2.34% pegs gold’s resilience amidst market unpredictability.

- A monthly increase of nearly 6% illustrates gold’s potential for profitability in investment portfolios.

- Continuous observation of market movements equips investors with necessary foresight to navigate the gold investing landscape.

How Is Today’s Gold Price Calculated?

The intricacies involved in the gold price calculation are pivotal for investors, economists, and market enthusiasts alike. Leveraging a combination of global market data and regional economic indicators, industry stakeholders can navigate through the dynamic domain where precious metals meet finance. Understanding the system behind these calculations sheds light on the fluidity and responsiveness of gold’s market value.

The Role Of Gold Exchanges In Price Setting

Gold exchanges across the world, such as the London Bullion Market Association (LBMA) and the Commodity Exchange, Inc. (COMEX), play a fundamental role in the setting of gold prices. The LBMA, for instance, is a key player in establishing the gold price benchmarks used globally. Here’s a brief rundown of how these markets influence the price:

- Auctions are held to determine the spot price of gold, balancing bids from buyers and sellers.

- Gold exchange influence is prevalent as these platforms provide the infrastructure for transparent and efficient trading.

- The gold price calculation hinges on spot prices which are updated in real-time during trading hours.

Influence Of Currency Fluctuations On Gold Rates

The currency impact on gold is undeniable, given the asset’s denomination in U.S. dollars for international trading. Variations in the strength of the dollar can send ripples through gold markets:

- An inverse relationship exists between the value of the dollar and the price of gold. A weaker dollar typically makes gold cheaper in other currencies and increases demand.

- Central bank interventions and forex market dynamics can sway gold prices significantly.

- Economic events, such as changes in interest rates or fiscal policy announcements, often precipitate swift responses in currency and gold markets.

The gold price today is a metric that reflects a network of economic activities, with gold exchanges orchestrating the symphony of supply-demand signals and currencies providing a backdrop that can enhance or diminish gold’s luster.

Historical Perspectives On Gold Valuation

An analysis of gold valuation history offers more than a snapshot of its market variability; it provides insight into the precious metal’s resilience as an asset class over time. To fully grasp the profundity of gold’s impact on financial markets, one must consider the 52-week gold pricing along with its long-term gold performance. These metrics collectively paint a picture of gold’s investment potential through various economic conditions.

52-Week Highs And Lows In Gold Pricing

Throughout its traded history, gold has exemplified both stability and spectacular ascents. This can be observed in its 52-week pricing data, showcasing a peak at $2,183 and a trough at $1,991. These indicators not only reflect the asset’s volatility but also underline the potential for profit in adept gold trading practices. Regular tracking of the 52-week pricing is crucial for investors aiming to capitalize on timely buying and selling opportunities.

Gold’s Long-Term Pricing Trends

When assessing long-term gold performance, one is met with the reality that gold has demonstrated a formidable average annual rate of return of 7.78% between 1971 and 2022. Such consistency in performance is indicative of gold’s appeal as a long-standing asset in diversified portfolios. The enduring allure of gold as an investment can largely be attributed to its hedging capabilities against inflation and currency devaluation.

Comparing Gold Investment Options

When considering adding the luster of gold to your investment portfolio, navigating through the various gold investment choices is essential. Understanding the nuances between each option can empower investors to make strategic decisions that align with their financial goals and risk tolerance.

Physical Gold Vs. Gold ETFs

Investors often grapple with deciding between investment in physical gold and gold ETFs. Physical gold provides a sense of security, direct ownership, and a tangible asset that can be held in one’s possession. Conversely, gold ETFs offer a form of indirect investment, with easier liquidity and no requirement for physical storage, appealing to investors seeking convenience and diversification.

Bullion, Coins, Jewelry, And Stocks

The term gold bullion coins refers to coins made primarily for investment purposes from gold of high purity. They represent a readily accessible way to invest in metal, often favored for their legal tender status and aesthetic value. Jewelry holds cultural significance and aesthetic appeal, though it typically carries higher premiums above the gold price due to craftsmanship.

Investors also commonly consider gold-related financial instruments in their portfolios. Stocks in mining companies, mutual funds, and commodities futures offer alternative paths to gold exposure, often influenced by market factors beyond the metal’s price alone.

- Physical Gold: Bars, coins, and jewelry for tangible wealth

- Gold ETFs: Tradeable funds reflecting gold prices, minus physical handling

- Gold Bullion Coins: Investment-grade coins with collectible and inherent gold value

- Gold Stocks: Equity in gold mining and exploration companies

Global Impacts On Today’s Price For Gold

The value of gold is a complex tapestry woven with threads that span across international borders, influencing and being influenced by a wide range of factors in the international gold market. Central to understanding gold pricing is acknowledging the profound effect that global influences on gold have. Whether it’s the result of fiscal policy changes by global central banks or the ripples of geopolitical conflicts, the repercussions are evident in the gold price impacts we observe in market valuations.

In this interconnected economy, the shimmer of gold reflects the current state of global affairs. Some of the key international forces that shape the landscape of gold pricing include:

- Trade agreements and tariffs, which alter the flows of gold between countries and regions.

- Varying economic policies and interest rates set by central banks such as the Federal Reserve, the European Central Bank, or the People’s Bank of China, each wielding the power to sway the gold markets significantly.

- Political unrest in gold-producing countries, which can hinder supply chains and inflate gold prices.

- Global demand for jewelry and technology, creating a sustained need for the precious metal, thereby affecting prices.

- Investors’ behavior in times of uncertainty, often turning to gold as a ‘safe-haven’ asset, driving up its price.

Notably, the canny maneuvers of international central banks hold a particular sway over the gold markets. Their reserve management strategies involving the purchase and sale of gold reserves serve as a barometer for gold’s market price. Any change in reserves – be it an accumulation or divestment – sends signals that traders and investors across the globe decode to forecast the precious metal’s trajectory.

As a result, those dwelling in the international gold market must maintain a vigilant watch on the myriad of global influences on gold, for they determine not just today’s rates but also sketch out the contours of future price trends.

Expert Strategies For Gold Investment

Investing in gold requires both finesse and a solid understanding of market dynamics. Successful investors don’t just follow the tide; they anticipate it, making informed decisions that are timed to maximize gains and minimize risk.

Timing The Market: Entry And Exit Points

Market timing for gold is much more than a guessing game. It’s an intricate dance with market indicators. Those with a keen eye on economic signals, interest rate trends, and geopolitical events hone their ability not only to foresee but also chart the most opportune moments to buy or sell gold. This kind of strategic timing hinges on a deep comprehension of cyclic patterns and fluctuating demand within the gold market.

Gold As Part Of A Diversified Investment Portfolio

Gold’s historic reputation for providing stability against the erratic nature of other investments makes it a lynchpin in portfolio diversification. Incorporating gold into an investment portfolio affords a cushion against market volatility and economic downturns, solidifying an investor’s financial stronghold. The diversifying power of gold is perennial, often inversely correlated with stocks and bonds, which makes it a strategic haven in times of uncertainty.

- Analyze and predict market trends to determine the best times to buy or sell gold.

- Use gold to mitigate risk in a wide-array investment portfolio.

- Observe gold’s stability as a valuable asset to shield against inflation and downturns.

By adhering to these gold investment strategies, investors are poised to make calculated moves that align with their financial goals and risk tolerance, leading to robust portfolio diversification and potential wealth accumulation.

Gold And Its Role As An Inflation Hedge

As a time-honored safe haven, gold has long been viewed by investors as an effective inflation hedge, often maintaining its purchasing power during times of monetary devaluation. Yet, gold’s relationship with inflation is multifaceted, with its role as a protector of wealth becoming more prominent over long-term horizons. Within this complex dynamic, it is vital to assess the historical performance of gold and understand its stability in the face of fluctuating inflation rates.

Understanding Inflation And Gold’s Value Stability

Despite its perception as a shield against the erosion of currency value, gold’s counteraction to inflationary pressures is not a straightforward affair. Gold’s price stability can be observed over extended periods; however, it might not align perfectly with inflation metrics in the short run. During times of heightened economic uncertainty, investors often flock to gold, seeking its relative price stability compared to more volatile assets.

Gold Prices In Inflation-Adjusted Terms

When viewing gold prices in inflation-adjusted terms, patterns emerge that underscore the precious metal’s reputation as a store of value. However, this reputation has been put to the test in certain eras, revealing instances where gold did not outperform other investments during periods of high inflation, thus providing a nuanced picture of its effectiveness as an inflation and gold balancing tool.

Decoding The Gold/Silver Ratio

For centuries, discerning investors have utilized the gold/silver ratio to gauge the relative value of these precious metals, and hence the opportunity for trading gold and silver based on comparative metal worth.

Trading Based On Comparative Metal Worth

The gold/silver ratio, in essence, quantifies how many ounces of silver are required to purchase a single ounce of gold at current prices. A high ratio indicates that, relative to gold, silver is less expensive; conversely, a low ratio suggests silver is more expensive, or gold is cheaper. These fluctuations in the ratio can present savvy traders with indicators for when to shift their asset allocation between these two metals.

- Increasing gold/silver ratio may prompt some investors to convert their gold holdings into silver, anticipating a reversion to the mean.

- A narrowing ratio could see investors do the opposite, exchanging silver for gold to capitalize on potential gains.

What The Ratio Tells About Market Sentiment

Moreover, this ratio reflects broader market sentiment and economic conditions, becoming a unique barometer for investor behavior. During times of economic stability, silver may perform well, leading to a decrease in the ratio. However, in uncertain times, gold’s status as a safe haven typically causes the ratio to rise as gold prices increase and silver prices might lag.

- A rising gold/silver ratio could indicate a market that is risk-averse or facing economic headwinds.

- Conversely, a declining ratio often corresponds with a more optimistic market outlook and rising industrial demand for silver.

In conclusion, gold/silver ratio analysis serves as a strategic component in trading gold and silver, informing decisions and offering insights into market sentiment that could lead to profitable investment movements.

Industrial And Commercial Uses Of Gold

Gold has been a cornerstone of human civilization for millennia, not just as a form of currency or investment, but also for its wide-ranging applications in various industries. Its remarkable physical attributes, which include resistance to corrosion, high malleability, and unparalleled electrical conductivity, have solidified gold’s place in the industrial sector. These properties, alongside gold’s aesthetic appeal, have sustained the gold demand over centuries.

From Electronics To Jewelry: Gold’s Versatility

One cannot overlook the gold industrial uses that permeate our modern lives. The role of gold in the technology sector is pivotal, as it is used extensively in electronics for its efficient conductive properties. Minute amounts of gold can be found in nearly every electronic device – from smartphones to advanced medical equipment. Another significant industry where gold’s virtues shine is in dentistry, where its biocompatibility and easy molding properties have made it a material of choice for dental fillings and crowns.

- Electronics: Gold’s excellent electrical conductivity ensures reliability in connectors, switches, and relay contacts.

- Dentistry: Gold alloys are prized for their durability, corrosion resistance, and aesthetic appeal.

- Aerospace: Gold-coated mylar is used in satellites and space suits to reflect infrared radiation.

The Constant Demand: Why Gold Maintains Its Worth

The commercial gold applications extend far beyond neatly etched circuit boards or the glint of an astronaut’s visor. The lion’s share of gold consumption stems from the jewelry industry, where approximately 75% of gold finds its application. Gold’s intrinsic luster and its status as a symbol of wealth serve to constantly fuel the demand. Moreover, gold’s non-consumable nature in these applications ensures that it rarely exits the market fold, thus maintaining perennial streams of demand that buttress its everlasting worth.

- Jewelry: A significant portion of gold is fashioned into various types of adornments, ranging from intricate traditional pieces to modern minimalist designs.

- Investment: Beyond its utility, gold holds tremendous value as an investment and a hedge against inflation.

- Central Banks: Reserves of gold serve to underpin the financial security of many nations, reflecting its unwavering appeal as a store of value.

Given its vast range of applications and the constant gold demand, one can easily understand why gold has never lost its luster in the eyes of both industries and investors alike. It continues to be a pivotal component of the global economy, displaying a resilience that few other commodities can claim.

Conclusion

Throughout this discourse, we’ve endeavored to provide gold investment insights that span from understanding the fluctuating rates to recognizing the various factors at play within the gold market. It’s indisputable that gold has stood the test of time, thriving as a coveted asset offering both stability and enduring value. For those venturing into the realm of precious metals, a thorough perusal of the gold market summary is imperative to harness the potential that gold investments hold.

The intricate dynamics of the gold market, including economic indicators and geopolitical events, extend a rich landscape for investors to navigate. This landscape is punctuated by opportunities for portfolio diversification and protection against inflation—two quintessential advantages for those seeking to secure assets with gold. Moreover, the tangible uses of gold in various industries further solidify its intrinsic value and substantiate its appeal as an investment choice.

Enlightened by the knowledge of current and historical gold prices, investment strategies, and a broad understanding of the metal’s practical utility, both novice and seasoned investors are better equipped to make judicious decisions. As such, gold emerges not merely as a commodity but as a cornerstone for savvy investment portfolios, epitomizing both affluence and security in the ever-shifting economic landscape.

FAQ

What Are The Current Gold Rates?

As of 8:20 am ET, gold is valued at ,165 per ounce, representing a 0.34% increase from the prior day’s price.

What Factors Are Affecting The Daily Gold Rates?

Gold prices are influenced by global economic conditions, inflation rates, central bank policies, currency valuations, especially the U.S. dollar, and geopolitical events.

How Can I Analyze Today’s Gold Market Dynamics?

You can examine economic indicators, assess historical market trends, and consider the impacts of supply and demand to understand today’s value of gold.

What Recent Movements Have Been Observed In Gold Prices?

Over the past week, there has been a 2.34% rise in gold prices and a 5.92% appreciation in the past month.

How Is Today’s Gold Price Calculated?

The spot gold price is determined by supply-demand equilibriums during auctions, which are influenced by currency exchange rates and economic events.

Can You Provide Some Historical Perspectives On Gold Valuation?

Over the last year, gold reached a 52-week high at ,183 and a low at

What Are The Current Gold Rates?

As of 8:20 am ET, gold is valued at ,165 per ounce, representing a 0.34% increase from the prior day’s price.

What Factors Are Affecting The Daily Gold Rates?

Gold prices are influenced by global economic conditions, inflation rates, central bank policies, currency valuations, especially the U.S. dollar, and geopolitical events.

How Can I Analyze Today’s Gold Market Dynamics?

You can examine economic indicators, assess historical market trends, and consider the impacts of supply and demand to understand today’s value of gold.

What Recent Movements Have Been Observed In Gold Prices?

Over the past week, there has been a 2.34% rise in gold prices and a 5.92% appreciation in the past month.

How Is Today’s Gold Price Calculated?

The spot gold price is determined by supply-demand equilibriums during auctions, which are influenced by currency exchange rates and economic events.

Can You Provide Some Historical Perspectives On Gold Valuation?

Over the last year, gold reached a 52-week high at ,183 and a low at

FAQ

What Are The Current Gold Rates?

As of 8:20 am ET, gold is valued at ,165 per ounce, representing a 0.34% increase from the prior day’s price.

What Factors Are Affecting The Daily Gold Rates?

Gold prices are influenced by global economic conditions, inflation rates, central bank policies, currency valuations, especially the U.S. dollar, and geopolitical events.

How Can I Analyze Today’s Gold Market Dynamics?

You can examine economic indicators, assess historical market trends, and consider the impacts of supply and demand to understand today’s value of gold.

What Recent Movements Have Been Observed In Gold Prices?

Over the past week, there has been a 2.34% rise in gold prices and a 5.92% appreciation in the past month.

How Is Today’s Gold Price Calculated?

The spot gold price is determined by supply-demand equilibriums during auctions, which are influenced by currency exchange rates and economic events.

Can You Provide Some Historical Perspectives On Gold Valuation?

Over the last year, gold reached a 52-week high at ,183 and a low at

FAQ

What Are The Current Gold Rates?

As of 8:20 am ET, gold is valued at $2,165 per ounce, representing a 0.34% increase from the prior day’s price.

What Factors Are Affecting The Daily Gold Rates?

Gold prices are influenced by global economic conditions, inflation rates, central bank policies, currency valuations, especially the U.S. dollar, and geopolitical events.

How Can I Analyze Today’s Gold Market Dynamics?

You can examine economic indicators, assess historical market trends, and consider the impacts of supply and demand to understand today’s value of gold.

What Recent Movements Have Been Observed In Gold Prices?

Over the past week, there has been a 2.34% rise in gold prices and a 5.92% appreciation in the past month.

How Is Today’s Gold Price Calculated?

The spot gold price is determined by supply-demand equilibriums during auctions, which are influenced by currency exchange rates and economic events.

Can You Provide Some Historical Perspectives On Gold Valuation?

Over the last year, gold reached a 52-week high at $2,183 and a low at $1,991, which helps indicate its market volatility and potential for profit.

What Are The Differences Between Investing In Physical Gold And Gold ETFs?

Physical gold offers tangible ownership, while gold ETFs provide flexibility without the costs of physical storage, though over time, ETF costs can surpass those of bullion.

What Global Impacts Are Influencing Today’s Price For Gold?

Gold prices are impacted by trade dynamics, geopolitical events, macroeconomic conditions, and the gold reserve policies of central banks.

What Are Expert Strategies For Investing In Gold?

Experts often suggest timing the market for entry and exit points and including gold in a diversified investment portfolio to mitigate risks.

How Does Gold Perform As An Inflation Hedge?

Gold is traditionally seen as an inflation hedge, offering value stability over the long term, but it may not always perform reliably in this regard in the short term.

What Is The Gold/Silver Ratio And How Is It Used In Trading?

The gold/silver ratio compares the value of gold to silver. Movements in this ratio can provide trading signals based on their relative values and market conditions.

What Are Some Industrial And Commercial Uses Of Gold?

Gold is used in various industries, from electronics to dentistry, but the largest demand comes from the jewelry industry which accounts for roughly 75% of gold usage.

,991, which helps indicate its market volatility and potential for profit.

What Are The Differences Between Investing In Physical Gold And Gold ETFs?

Physical gold offers tangible ownership, while gold ETFs provide flexibility without the costs of physical storage, though over time, ETF costs can surpass those of bullion.

What Global Impacts Are Influencing Today’s Price For Gold?

Gold prices are impacted by trade dynamics, geopolitical events, macroeconomic conditions, and the gold reserve policies of central banks.

What Are Expert Strategies For Investing In Gold?

Experts often suggest timing the market for entry and exit points and including gold in a diversified investment portfolio to mitigate risks.

How Does Gold Perform As An Inflation Hedge?

Gold is traditionally seen as an inflation hedge, offering value stability over the long term, but it may not always perform reliably in this regard in the short term.

What Is The Gold/Silver Ratio And How Is It Used In Trading?

The gold/silver ratio compares the value of gold to silver. Movements in this ratio can provide trading signals based on their relative values and market conditions.

What Are Some Industrial And Commercial Uses Of Gold?

Gold is used in various industries, from electronics to dentistry, but the largest demand comes from the jewelry industry which accounts for roughly 75% of gold usage.

,991, which helps indicate its market volatility and potential for profit.

What Are The Differences Between Investing In Physical Gold And Gold ETFs?

Physical gold offers tangible ownership, while gold ETFs provide flexibility without the costs of physical storage, though over time, ETF costs can surpass those of bullion.

What Global Impacts Are Influencing Today’s Price For Gold?

Gold prices are impacted by trade dynamics, geopolitical events, macroeconomic conditions, and the gold reserve policies of central banks.

What Are Expert Strategies For Investing In Gold?

Experts often suggest timing the market for entry and exit points and including gold in a diversified investment portfolio to mitigate risks.

How Does Gold Perform As An Inflation Hedge?

Gold is traditionally seen as an inflation hedge, offering value stability over the long term, but it may not always perform reliably in this regard in the short term.

What Is The Gold/Silver Ratio And How Is It Used In Trading?

The gold/silver ratio compares the value of gold to silver. Movements in this ratio can provide trading signals based on their relative values and market conditions.

What Are Some Industrial And Commercial Uses Of Gold?

Gold is used in various industries, from electronics to dentistry, but the largest demand comes from the jewelry industry which accounts for roughly 75% of gold usage.

,991, which helps indicate its market volatility and potential for profit.

What Are The Differences Between Investing In Physical Gold And Gold ETFs?

Physical gold offers tangible ownership, while gold ETFs provide flexibility without the costs of physical storage, though over time, ETF costs can surpass those of bullion.

What Global Impacts Are Influencing Today’s Price For Gold?

Gold prices are impacted by trade dynamics, geopolitical events, macroeconomic conditions, and the gold reserve policies of central banks.

What Are Expert Strategies For Investing In Gold?

Experts often suggest timing the market for entry and exit points and including gold in a diversified investment portfolio to mitigate risks.

How Does Gold Perform As An Inflation Hedge?

Gold is traditionally seen as an inflation hedge, offering value stability over the long term, but it may not always perform reliably in this regard in the short term.

What Is The Gold/Silver Ratio And How Is It Used In Trading?

The gold/silver ratio compares the value of gold to silver. Movements in this ratio can provide trading signals based on their relative values and market conditions.

What Are Some Industrial And Commercial Uses Of Gold?

Gold is used in various industries, from electronics to dentistry, but the largest demand comes from the jewelry industry which accounts for roughly 75% of gold usage.